There’s no escaping the fallout from locking down the economy of a country, but what effect it will have depends on the magnitude of it all.

For example, the longer it drags on the worse it logically becomes for more and more people and businesses across the world. The more money printed, the greater the debt and effect on future generations.

Already the statistics reveal a situation that is greater than the GFC (Global Financial Crisis of 2008) with the USA reporting more than 10 times (10x) the number of people out of work than was experienced during the GFC.

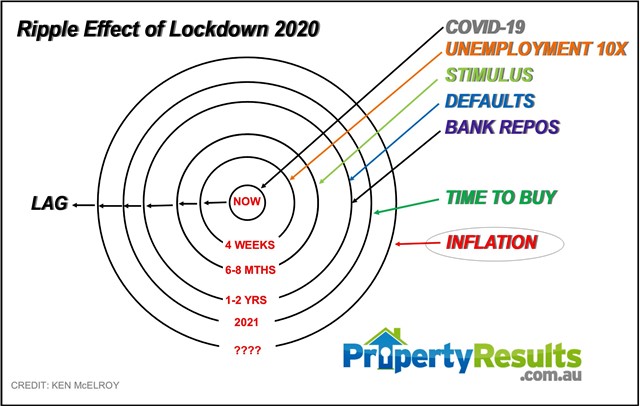

There’s also the ripple effect that is likened to the ripples that emanate after a stone is thrown into a pond. The diagram below is what we believe is the effect the lock-down in 2020 will have on the property market.

The elephant in the room is the looming depression like economic fall out heading our way, and the repercussions for all countries around the world will be similar as they are all printing money and diluting the value of currencies in the process. The Central Banks are getting ready for their biggest party ever, and the fleecing of assets is about to occur during the collapse.

The final battle will be with the issue of inflation. If anyone thinks Australia has low inflation and believes the Government reported statistics of less than 3%pa, then you’ve been tricked. If inflation effects the buying power of our currency, then just consider how expensive things have become in the last few years. That’s inflation! And with all the money printing and estimated $4billion in Government debt, the costs will be compounding over time. We predict inflation will be the new challenge by 2022 for the majority, yet many opportunities will arise for educated individuals.