What Will Business Look Like After 2020?

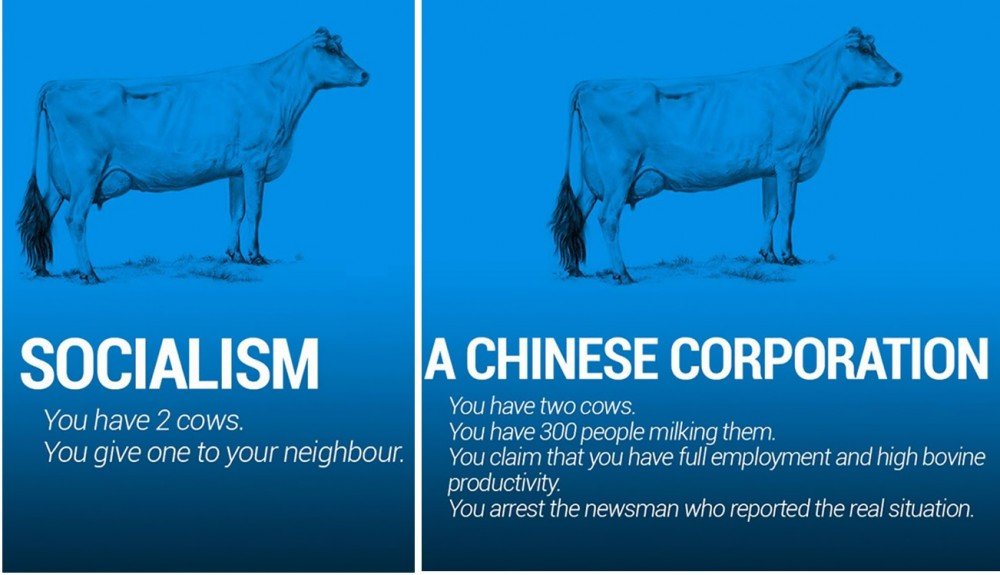

Two Cows might be a simple way to explain world economics, but as a light hearted perspective, there’s entertainment value in it.

It seems that during tough times, entertainment becomes a popular pursuit and casting back to the GFC, weekend getaways, movies, eating out and socialising were things we did more of in an effort to escape the negativity and a failing financial system.

Fast forward 12 years and entertainment during the virus lock-downs looks more like jigsaw puzzles, board games, takeaway food & coffee, online courses, art and hobbies and most other things one can do from the comfort of their residential prison. But this time the stakes have been raised with Governments around the World pumping cash into the hands of workers and businesses in a bid to keep their fragile economies afloat. If nothing else, we celebrate the short term windfall like the sugar hit it is, then contemplate the reaction when the grants run out in September 2020, at least for Australian recipients.

With a seemingly unlimited supply of dollars gleefully loaned to Government by the Central Bank, the sugar party has created a mountain of debt that has no chance of being paid back unless interest rates go below zero, our economy booms for the next 15 years and Government at all levels become frugal with expenditure. What are the chances? Essentially we have therefore become indebted to the private individuals of the Central Banking Cartel.

With a seemingly unlimited supply of dollars gleefully loaned to Government by the Central Bank, the sugar party has created a mountain of debt that has no chance of being paid back unless interest rates go below zero, our economy booms for the next 15 years and Government at all levels become frugal with expenditure. What are the chances? Essentially we have therefore become indebted to the private individuals of the Central Banking Cartel.

Where does this lead to? We all know that if we borrow more than we can afford, there are sacrifices to be made in keeping on top of repayments. Its a tough pill to swallow, but the Government will need to take measures willingly or otherwise, to get on top of the debt and attempt to reduce it at all costs. God forbid the Central Bank increasing interest rates in the next few years to counteract rampant inflation brought about by printing too much money! We could all be working in sweat shops alongside our kids to make ends meet.

When we consider that this orchestrated increase in power by the Central Banks, dovetails nicely with an agenda for a new World order, we might speculate it will lead to Socialist Governments, stupid taxes, forced vaccinations and loss of social freedoms, but that’s another topic.

The question right now is; what will business look like after 2020? I wrote a letter to the Federal Trade Minister yesterday encouraging a new “World Trade Taskforce” be established by the Government to assist Australian businesses push into new export markets in a bid to reduce their reliance on China. It would resemble a “Border Force” kind of organisation, but for business and commerce. I mention this because currently, Australia stands to suffer economically by boycotts imposed by China on Aussie exports, with processed beef and barley exports being the first casualties in May 2020. So we find other customers right? We should be encouraged by Sweden, who are standing up for THEIR principles.

Back on the topic of “what will business look like after 2020?”, We should expect the current Liberal Government to implement strategies to stimulate the economy once it resumes from “hibernation”. This will likely include incentives to speed up the engine room of the Australian economy, primarily business that generates revenue for the country like manufacturing, value adding to existing raw product, construction and housing. What form these incentives will take is unknown, but sure as hell the states will need to tow the line. Its a mess considering each state has their own extreme level of debt that each successive Government will deal with in various ways.

Anti business taxes like payroll tax and stamp duties will have to be scaled back, or eliminated. Compulsory superannuation that Paul Keating imposed upon business to support the financial services industry, will need to be made “elective” so that people get more money in their pockets. Seriously, who benefits from the current system of compulsory super? With an ever increasing casual and contractor based workforce, the piecemeal sums accumulated in workers super accounts never grows because the fund managers trim the fat for themselves, thanks to Mr Keating and ever changing regulation of the Superannuation Act.

Change is great, if you are in the right position to benefit from the changes, and moving past 2020, expect there will be many. Business and self employment via a company or trust will become the best way to operate in the future as a means of taking advantage of tax incentives and controlling ones own cashflow. Expect to pay higher GST if not now, at least when states push for more money or Labor is re-elected to Federal Government. Italy also implemented a 10% GST, but now have a 22% consumption tax on almost everything.

And beware the misguided socialist academics who seek to influence Government policies on agenda they believe to be ideal. Take the Grattan Institute, they regularly promote left wing content written by their unqualified uni graduates who failed to survive in an environment of value adding and productivity – the Private Sector. In one article they promoted the notion that wealthy retirees of the Baby Boomer era, were not entitled to the money they received over the years via employer funded superannuation, and it should be paid back or taken away from them to fund programs or housing for less fortunate Millennials and Gen X’ers. Stop me!

The Two Cows economic summary might be looking more realistic the longer we ponder the complexities and challenges that await citizens in Australia an other countries as we move forward past 2020. A positive outlook and independent thinking will be beneficial to making the most of the fun times ahead.

![]()