In this two part article we are reviewing some of the reasons that might play a role in making it difficult for people to pay their mortgage.

In this two part article we are reviewing some of the reasons that might play a role in making it difficult for people to pay their mortgage.

You’ve probably experienced the hype about the real estate market. Real Estate Agents, and the newspapers/media that provide property advertising have been talking the market up for the last 12 months, and banks are in on the act touting for your home loan business with interest rates the lowest we’ve ever seen.

But if you have any connection to the market, like own a house or unit, or applied for a loan recently, you’re probably scratching your head wondering where all the action is! The banks are cautious and their lending criteria reflects just how high the bar is set. Agents are offering free appraisals on your home in a bid to boost stock levels, which they say are running short because of the huge buyer demand currently being experienced. But wait a second, wouldn’t that make it a “sellers market”?

We clearly don’t have sellers dictating to the market, it is very much the other way around. Tried selling your house lately? The reality is, any property perceived by the market (buyers) as a hot deal, can be expected to sell reasonably quickly, but generally, those who don’t need to sell are being urged not to, unless they are prepared to accept a sale at around 2007 price levels. No surprise that Auctions are popular as a way to get buyers to take interest. For Agents, it makes more sense advertising the “desperate” style of headline to attract buyers where there is no disclosure of price, which may otherwise risk putting buyers off.

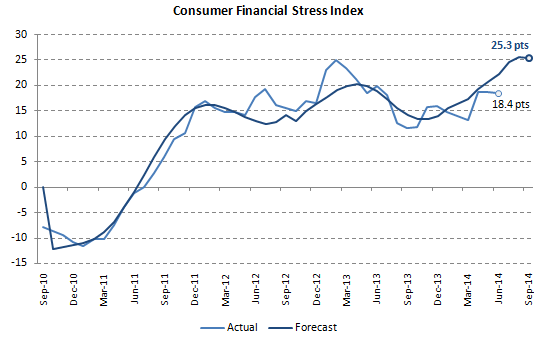

But why are debt collection agencies raising the warning bells on the property market in the wake of statistics pointing to increasing mortgage stress? After referring to the chart above, we can surmise that things aren’t really all as good as it seems in the economy which may be why the spike in the projections. We know that retailers generally are struggling and wages growth going backwards, not to mention significant industries shedding workers at a rate not seen since the start of the “technology revolution”. Things appear to be heading in a negative direction, but could it really be a natural “resetting” of the economic landscape? Many would argue that retail rents needed to come back to balance the reduction in consumer spending and there have been many businesses that haven’t survived the slow down. Manufacturers too, needed to reduce staff to compensate for lower demand for Australian products nationally and internationally, the Government even had to address an excess of staff and people on the payroll after Labor got the boot in the last election.

But why are debt collection agencies raising the warning bells on the property market in the wake of statistics pointing to increasing mortgage stress? After referring to the chart above, we can surmise that things aren’t really all as good as it seems in the economy which may be why the spike in the projections. We know that retailers generally are struggling and wages growth going backwards, not to mention significant industries shedding workers at a rate not seen since the start of the “technology revolution”. Things appear to be heading in a negative direction, but could it really be a natural “resetting” of the economic landscape? Many would argue that retail rents needed to come back to balance the reduction in consumer spending and there have been many businesses that haven’t survived the slow down. Manufacturers too, needed to reduce staff to compensate for lower demand for Australian products nationally and internationally, the Government even had to address an excess of staff and people on the payroll after Labor got the boot in the last election.

But have we determined why mortgage stress is fast becoming a hot topic? It is a fact there are more people who are earning less and can’t afford their lifestyle. The economics are a part of the issue. And as mentioned earlier, banks and financiers have made borrowing difficult unless you don’t mind giving them everything you own. While interest rates might seem low, banks are controlling the flow of money and cherry picking the best of the best deals. They achieve this by lowering their valuations and using extremely conservative criteria to assess serviceability, two of the key components in a lender’s assessment kit. Borrowers are therefore forced to put more of their own cash into the deal to reduce the loan amount or otherwise provide additional equity from property that may be unencumbered. In addition, they will discount the serviceability figures (income) you provide them and require you to provide more income or reduce the amount you can borrow. The banks are setting themselves up to gain more of the pie for less effort. (Continued….part 2)

But have we determined why mortgage stress is fast becoming a hot topic? It is a fact there are more people who are earning less and can’t afford their lifestyle. The economics are a part of the issue. And as mentioned earlier, banks and financiers have made borrowing difficult unless you don’t mind giving them everything you own. While interest rates might seem low, banks are controlling the flow of money and cherry picking the best of the best deals. They achieve this by lowering their valuations and using extremely conservative criteria to assess serviceability, two of the key components in a lender’s assessment kit. Borrowers are therefore forced to put more of their own cash into the deal to reduce the loan amount or otherwise provide additional equity from property that may be unencumbered. In addition, they will discount the serviceability figures (income) you provide them and require you to provide more income or reduce the amount you can borrow. The banks are setting themselves up to gain more of the pie for less effort. (Continued….part 2)

CLICK HERE to read Part 2 of this article